Advertising and Trading | The Markets’ Problem Twins

[Editor’s note: While this article was written well before the current stock market decline, it provides context for the current debate over the stimulus strategy to bail out the current systems. We should ask what exactly we are trying to ‘preserve’. Hazel wrote to me to say, “Investment needs to focus on the future, specifically people with real needs and the Green New Deal, not on bailing-out our cruise lines which do not pay US taxes, or the fossilized fossil-fuel industry.”]

Markets are ubiquitous in all human societies. Since earliest times, when they were conducted using shells, wampum, cattle, or in rituals and potlatches, markets evolved using metal coins, silver and gold, then paper, government-issued fiat, and now morphing into today’s cryptocurrencies. Today, two familiar offspring of markets—advertising and trading—have become overgrown, largely unnecessary, and often downright problemic. For example, advertising drives Silicon Valley giants Google and Facebook whose profits come from ads; likewise with Amazon, Apple, Microsoft, and other huge retailers and other companies in the digital economies of today. Advertising dominates our commercial media, often influencing the content of its programs. In the 20th century, it was deemed necessary to encourage advertising to grow the GDP-measured consumer economy, particularly in the USA, so advertising was made deductible from company balance sheets.

Today, while some 70 percent of the US economy is dependent on consumption of goods and services, ads are so ubiquitous that many pay for apps to block them out! They have invaded our homes and political processes with much “fake” content. Do we now have more advertising than needed, especially that promoting unsustainable products, forms of waste, and unhealthy consumption? The USA is the only country in the world that permits paid advertising of medical drugs widely promoted on television. Maybe we can reduce the tax-deduction for advertising, as proposed in UN Human Development Report, “Truth in Advertising Assurance Set-Aside” (1997, www.undp.org). This would help make ads more truthful, by awarding the small funds set aside to public interest groups with more truthful information, such as those which revealed the health dangers of tobacco.

Now let’s look at trading—the other overgrown problem child of markets, particularly evident on Wall Street and stock markets around the world as they have “financialized” economies in many countries, preying on “Main Streets” rather than providing them with needed investments for companies and startups. The most obvious problem child is high-frequency trading (HFT), as written about by Michael Lewis in Flash Boys (2014). These computerized trading systems operate on speed and seek to beat all other orders to the exchanges to get lower prices for their orders. This is called “front-running,” and is estimated to cost all other legitimate stock brokers and traders on Wall Street about $400 million annually. Most stock trades are now conducted by computers using algorithms with deeply-buried assumptions which we can only hope are accurate. Yet today, many of these algorithms are used to decide whether people get jobs, raises, pensions, or are sent to jail! The new evidence on algorithms’ mistakes made the new watchword “bias in-bias out,” beyond the older warning of “garbage in-garbage out.”

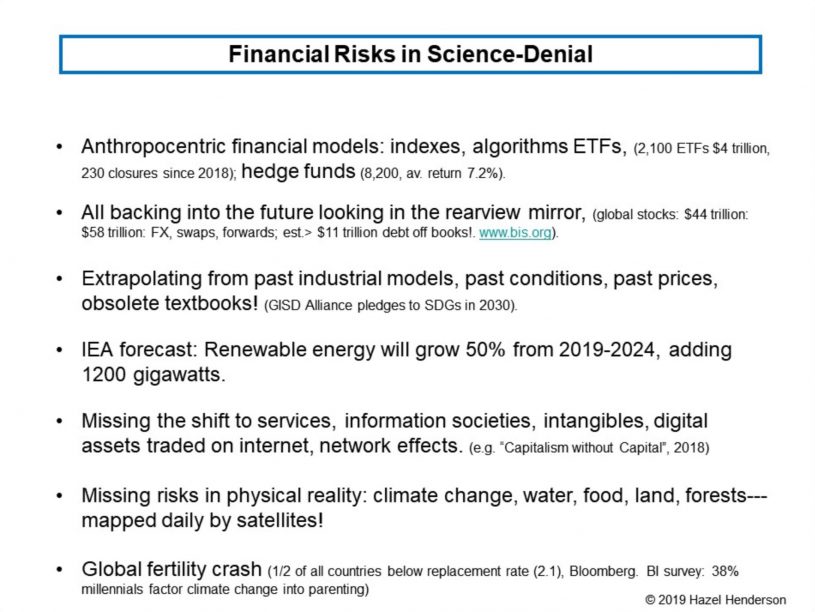

Trading as a proprietary activity for big firms on many stock markets has now become predominant, and is often little more than making money out of money. Traders feverishly buy and sell stocks of existing companies to each other, rather than looking for new enterprises and market opportunities to finance. A recent study of traders in London’s Canary Wharf exchange took cheek swabs from traders and found their testosterone levels elevated. In The Hour Between Dog and Wolf (2012), biochemist and former trader John Coates analyzed the behavior of such traders and found impaired risk assessment and judgement! Many are now looking at excessive day-trading as an aberrant behavior pattern similar to gambling. Similar accounts as to the addictive nature of trading are by Wall Street Journal reporter Scott Patterson, author of Dark Pools (2012), who described in vivid detail traders with buckets at their desks to avoid bathroom visits, and other kinds of obsessive, highly-risky behavior. All this trading is based on anthropocentric models, indexes, ETFs, and passive investing based on obsolete textbook concepts and risk-assessments which ignore the rising environmental and other global risks in the real world. Many pensions and 401(k)s rely on such trading, based on magical thinking, creating financial risks due to science-denial, as described in “Transitioning to Science-Based Investing” (2019–2020). Trading permits to pollute the air and water are now seen as a moral outrage when today’s deaths from air pollution are reported a 9 million annually. Yet emissions trading persists in many “cap and trade” schemes while emissions keep increasing. Instead of more rational taxes on polluters, these trading of licenses to pollute were launched in Kyoto, in 1997, by enterprising economists whose trade associations had urged them “to capture this (climate) issue for our profession,” as I reported in Building a Win-Win World (1996). In 2019, at the UN’s COP25 in Madrid, emissions trading was still an unresolved issue (see “From Rigged Carbon Markets to Green Growth” (2011)).

Markets evolved from early individual and community bartering in villages and town squares to currency-based trading, national stock exchanges, and today’s global satellite and internet-based 24/7 electronic trading and financialization. Few recognize that today’s global markets are based on taxpayer-supported public investments in R&D, the internet, fiber optic cables laid under oceans, satellites developed by NASA, as well as all radio, TV, Wi-Fi, and other communications using the publicly-owned airwaves. We drew attention to this rarely-acknowledged debt to taxpayers and how this requires higher standards of all financial markets in the public interest, in our 2010 Statement on “Transforming Finance,” signed by some 100 concerned financial professionals.

As markets expanded in 18th-century Britain and Europe, the societal patterns they influenced were mapped approvingly by Adam Smith in The Wealth of Nations (1776), as being guided by a benevolent “invisible hand,” along with his earlier caveats in The Theory of Moral Sentiments (1757), in which he stressed the need for ethical interpersonal relations and regulatory oversight by societies in the public interest. Karl Marx weighed in with Das Kapital (1867), a widely-influential, dour overview of markets’ oppression of workers and coalescing into national and international forms of domination he labelled “capitalism,” driven by increasing accumulation, hoarding, and enclosure of common global resources. Debates on the role of markets versus the state, individual roles of workers and citizens in democratizing societies continue to this day. Few mentioned advertising as a problem until 1957, when Vance Packard wrote The Hidden Persuaders, following Stuart Chase’s The Tyranny of Words (1938). Few referred to trading as excessive until Michael Lewis exposed the depredations of HFT in skimming all investors by front-running, or as a new kind of addiction identified by John Coates and Scott Patterson.

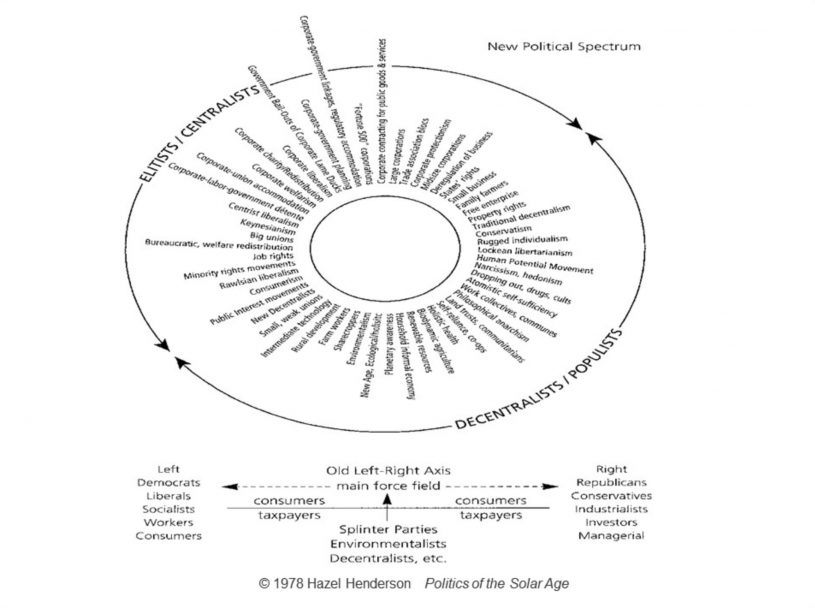

In the 20th century, two world wars and a cold war were fought over how industrial societies and markets would evolve. In 1970, the Bank of Sweden lobbied the Nobel prize committee to set up its new prize in economics—attempting unsuccessfully to justify this discipline as a science. Ideological forces positioned themselves along an imaginary horizontal line from left to right (using terminologies including: communism, socialism, capitalism, fascism, authoritarianism, totalitarianism, libertarianism, populism, and anarchism). This 20th-century visualization still dominates political discourse today, instead of seeing how actual societies have differentiated into a complex spectrum of views, roles, based on evolving technologies, markets, institutions, education, migration, and geographies (see Paradigm Shift in European Elections).

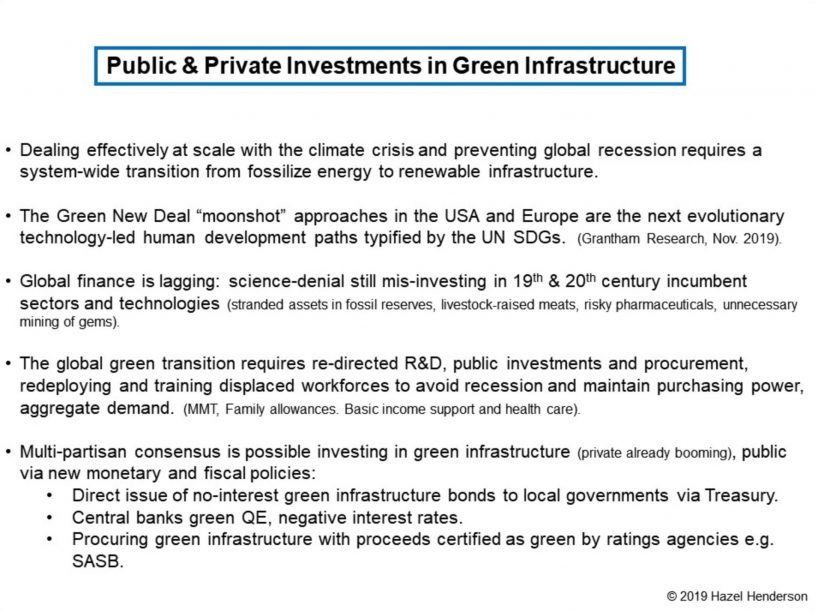

After the Great Depression of the 1930s, the general realization emerged that while markets brought much development and technological advance, they needed to be tamed and restrained by political and legal regulation. Opponents cited economics, advocating their views of the invisible hand guiding “free” markets—equating them with democracy versus governments as tyranny. These arguments, along with the new “Bank of Sweden Nobel Memorial” prize in economics invoked science in mathematizing equilibrium models from Newtonian physics of “efficiency” and “market completion” (Arrow-Debreu (1957)). President Franklin Roosevelt’s New Deal was based on government credit and guarantees which created the Hoover Dam and water supplies—without which Arizona could not have developed and Los Angeles still would be a village. Today’s Green New Deal, like President Kennedy’s 1960s “moonshot,” also is based on government credit and justified in Modern Monetary Theory (MMT) challenging earlier monetarism (Kelton, Colander, Wray, et. al.). The “mixed economies” of John Maynard Keynes emerged in the 1930s in many forms, as societies determined what roles markets would play, what tasks were to be paid by “breadwinners,” and which others were to be performed voluntarily (mostly by women in maintaining households, raising children, and serving their communities), as I described in The Politics of the Solar Age (1981, 1986) and Building a Win-Win World (1996). Some forms of government were called Christian socialism, others democratic socialism, market democracies, or socialism with Chinese characteristics (otherwise referred to as state capitalism). Green parties arrived in Europe in the 1980s, and are becoming major forces in Germany, Austria, and the European Parliament, advocating the Green New Deal proposals, similar to those favored by proponents in the USA.

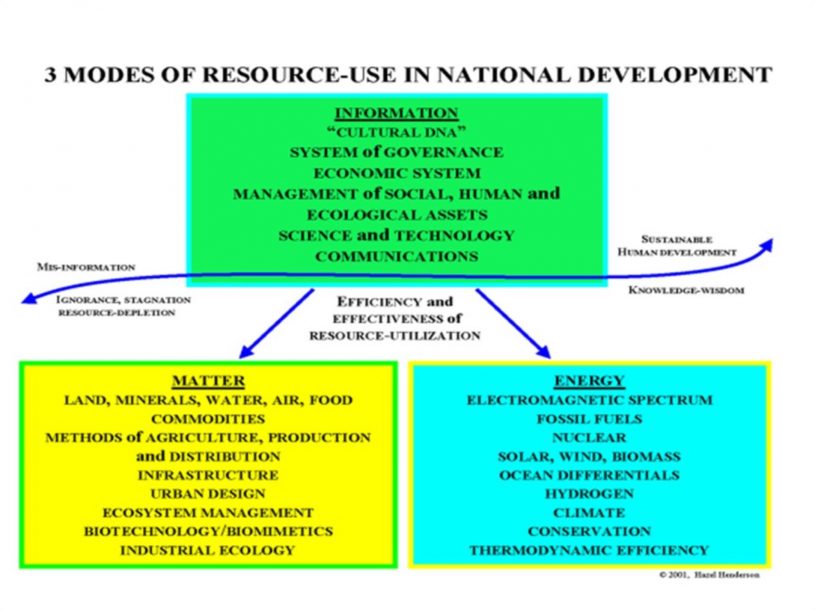

All of these 19th- and 20th-century monikers, ideologies, and the hot and cold wars they engendered are now morphing into today’s “Information societies” of our next Solar Age—circular economies. Digital, information-based internet platforms continue colonizing sectors of older material production-based industrial societies. Sector after sector falls to digitization—its destruction of jobs, the insecurity of “gig” economies, self-employment, and wholesale unemployment for the less-skilled. First, manufacturing fell to automation in the auto and textile industries in the 1960s, leading to the creation of new visions of “post-industrial, leisure-based societies” described by the Ad Hoc Committee on the Triple Revolution on the need to maintain purchasing power by guaranteeing basic incomes and equality, “Purchasing Power-Why Basic Income Is A Human Right” (Forbes 2017). President Richard Nixon ordered an early experiment on “universal guaranteed incomes” and circulated the proceeding of his “White House Conference on the Industrial World Ahead” (1972). Today, Silicon Valley titans call for such universal basic incomes to maintain consumers’ purchasing power to buy their products and bolster aggregate demand, but funded by taxpayers, rather than through increasing taxes on social media profits.

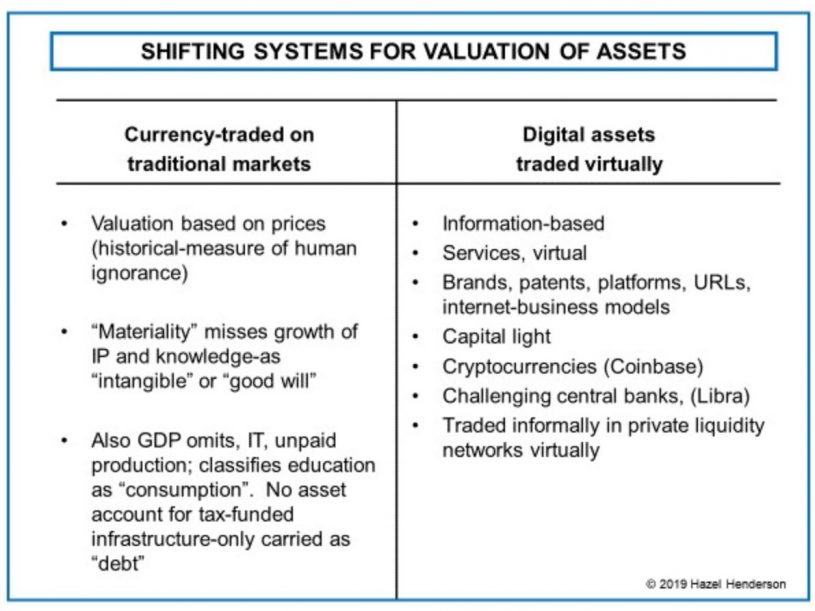

Today, manufacturing sectors in the USA represent less than 20 percent of the economy, now mostly based on services. As manufacturing was offshored to cheaper labor countries, digitization conquered retailing, traditional publishing, and communications media, and spread to law, medicine, accounting, management, and to financial markets globally. Digital assets are traded electronically by algorithms on stock markets operating globally online, as well as on the internet by informal private liquidity networks. The fundamental fragility of over-reliance on digitalization and internet platform availability is exposed by the rise of cybercrime and info-warfare described by Andy Greenberg in Sandworm: A New Era of Cyberwar and the Hunt for the Kremlin’s Most Dangerous Hackers (2019). As Silicon Valley continues developing ever more internet-reliant business models based on sensors, software codes, AI, and the so-called Internet of Things, we see their naïve faith in electricity (still mostly produced by fossil fuels). The vaunted digital economy evaporates with power cuts, as fires in California make blackouts an existential risk for the next decade, as I described in “Silicon Valley Karma: Faith In Electricity” (2019).

Today, manufacturing sectors in the USA represent less than 20 percent of the economy, now mostly based on services. As manufacturing was offshored to cheaper labor countries, digitization conquered retailing, traditional publishing, and communications media, and spread to law, medicine, accounting, management, and to financial markets globally. Digital assets are traded electronically by algorithms on stock markets operating globally online, as well as on the internet by informal private liquidity networks. The fundamental fragility of over-reliance on digitalization and internet platform availability is exposed by the rise of cybercrime and info-warfare described by Andy Greenberg in Sandworm: A New Era of Cyberwar and the Hunt for the Kremlin’s Most Dangerous Hackers (2019). As Silicon Valley continues developing ever more internet-reliant business models based on sensors, software codes, AI, and the so-called Internet of Things, we see their naïve faith in electricity (still mostly produced by fossil fuels). The vaunted digital economy evaporates with power cuts, as fires in California make blackouts an existential risk for the next decade, as I described in “Silicon Valley Karma: Faith In Electricity” (2019).

All these changes have left economic textbooks, financial courses, and MBA curricula far behind, as described in “Business School Students Are Putting the Planet Before Profits,” Bloomberg BusinessWeek (Nov. 4, 2019). In this new century’s Information age, traditional stock markets are at last focusing on trading itself as excessive, too fast, as in HFT and computer driven algorithmic portfolios, index funds, ETFs, and robo-investments and advisors. Science-denial in trading and speculating still ignores real world risks to societies: inequality, pollution, and climate change. Commodity markets’ speculation, including for monocultured food grains, have led to poverty and exacerbated hunger and malnutrition in many countries. Many stock markets are now little more than passive investment platforms for trading between market players of secondary assets, rather than acknowledging the new global threats, widening inequality, and the needs for providing funds for real economies on the ground. Macroeconomic statistics exclude other scientific data on global conditions as they view the world from 60,000 feet, providing little understanding of the lives of people in “flyover country.” This GDP-driven global growth has exacerbated much regional and local inequality, which led to recent so-called “populist” revolts in many countries, as well as the adoption, in 2015, by all UN member countries of the more systemic steering metrics of the Sustainable Development Goals (SDGs) (see also “Steering Societies From GDP’s 7 Deadly Sins to the SDGs Golden Rule” (2019)).

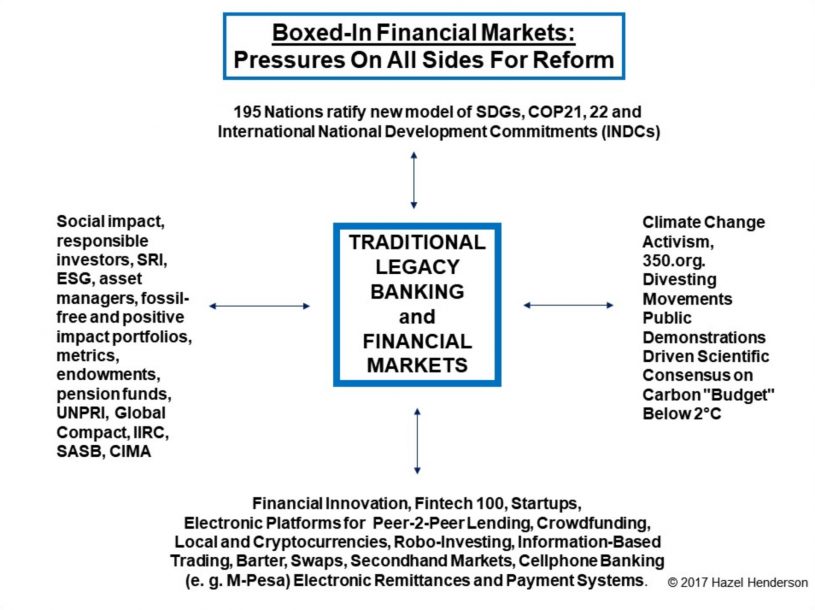

Incumbent financial markets are losing credibility, as they continually lobby lawmakers to repeal safeguards enacted after the crisis of 2008. They are challenged from all directions by socially responsible, ethical, green investors’ “impact funds”; by divestment movements including 350.org and student movements to purge portfolios of stranded assets in fossilized investments. Financial technology (fintech) incursions take over their traditional lending and payments, by digitized fintech companies’ payments and remittance services, crowdfunding, p2p lending and blockchain-based cryptocurrencies challenging central banks. Central bankers fight back with more quantitative easing (Q.E.), negative interest rates (see “Ben Bernanke and Milton Friedman Were Right: Helicopter Money or Qualitative Easing?” (2016)), and by creating their own digital currencies (Huber 2019). Added to these pressures are the edicts from above, as finance ministers demand disclosure of climate risks (see TFCD) and steer societies beyond GDP metrics, targeting instead the UN’s SDGs by 2030.

Incumbent financial markets are losing credibility, as they continually lobby lawmakers to repeal safeguards enacted after the crisis of 2008. They are challenged from all directions by socially responsible, ethical, green investors’ “impact funds”; by divestment movements including 350.org and student movements to purge portfolios of stranded assets in fossilized investments. Financial technology (fintech) incursions take over their traditional lending and payments, by digitized fintech companies’ payments and remittance services, crowdfunding, p2p lending and blockchain-based cryptocurrencies challenging central banks. Central bankers fight back with more quantitative easing (Q.E.), negative interest rates (see “Ben Bernanke and Milton Friedman Were Right: Helicopter Money or Qualitative Easing?” (2016)), and by creating their own digital currencies (Huber 2019). Added to these pressures are the edicts from above, as finance ministers demand disclosure of climate risks (see TFCD) and steer societies beyond GDP metrics, targeting instead the UN’s SDGs by 2030.

American and European activists’ and politicians’ demands for “Green New Deal” policies target restructuring of finance and economies to focus “moonshot” policies to build out green infrastructure. These policies propose a new social foundation for a just transition for all workers, including support and retraining to fill the thousands of new jobs that will be needed (see Nick Robins et al., “A Just Transition,” Grantham Research Institute, LSE (Feb. 4, 2019)). The US Congress Green New Deal Resolution is widely-supported and endorsed by all Democratic candidates in the 2020 presidential election, and buttressed by scientists, engineers, green investors and companies, NGOs, and the theoreticians of MMT. In Britain, struggling with its Brexit debacle, seen as a symptom of disastrous “austerity” economics, the Labour Party’s Jeremy Corbin, along with many NGOs, including Positive Money and the New Economics Foundation, set forth detailed transition plans to “green” finance the Bank of England and restructure their economy more democratically (see “A Green Bank of England” (2018)). Similar efforts to “green” China’s Belt and Road financing of infrastructure are under way (see Ma Jun and S. Zadek, “Decarbonizing Belt and Road,” Tsinghua University Shanghai, China (Sept. 4, 2019)).

Many see reducing the role of incumbent markets in favor of government credit to support new greener markets, community cooperatives, credit unions, and home-grown local economies embedded in their environments and the society. Many also advocate recognition of all unpaid caring work, which in most countries is the uncounted up-to-50 percent of all productive work in their societies (Henderson, “The Love Economy” (1981)). Textbook economic theories are further challenged by digitization, and the shift to service economies, digital assets, patents, copyrights, brands, domains, and electronic barter. These intangible values, including unpaid care and volunteering, remain uncounted by most economists and accountants, who still focus on tangible goods you can drop on your foot. This shift to “weightless” economies and “capital-light” start-ups is described in Capitalism Without Capital: The Rise of the Intangible Economy, by J. Haskel and S. Westlake (2018). These massive transitions including blockchain-based cryptocurrencies and business models raise age-old questions: who owns the blockchains and who writes the computer codes? Who controls these new businesses? And who oversees and regulates all this to protect the public interest?

All this rethinking responds to imminent crises and the effects of climate change, now experienced first-hand in many countries. Excessive advertising, along with excessive trading, is at last, in the crosshairs: accused of selling people all over the world wasteful unsustainable forms of consumerism and social irresponsibility. Advertising drives the now-unsustainable profits in business models such as those of Google and Facebook (almost entirely based on advertising revenues), as well as Apple and Amazon, based on retailing of ever more goods and services, and the dominance with Microsoft, IBM, and others of digital markets and cloud computing. Advertising versus apps blocking ads form a new arms race between individuals and excessive numbers of ads. These distracting ads popping up on our screens also crowd out much commercial media airtime and attention needed for vital information for citizens in democracies, as well as influencing the content of programming, as I describe in “Mediocracies and their Attention Economies” (2017). Our EthicMark® Awards, founded in 2004, which recognize “socially responsible advertising and media communications that uplift the human spirit and society,” have helped raise the bar on the $600 billion annual global advertising industry. Winners draw attention to game-changing public service advertising from many countries around the world serving as new models. Unilever withdrew all its advertising from Google and Facebook in 2018, due to their “toxic content,” and other companies see their precious brands and reputations threatened on social media. Corporations are drawn into politics in P. Kotler’s and C. Sarkar’s book, Brand Activism (2019), and followed online by the “Brands Taking Stands” media platform.

The Silicon Valley giants’ business models relying on advertising are now challenged from many directions for their ever-deeper incursions into users’ privacy, manipulating personal behavior and addicting our children in the newly-diagnosed “Gaming Disorder” and digital attention deficit disorders. These “engagement algorithms,” designed by psychologists and Stanford University’s Persuasive Technology Lab, focus on emotional arousal, offering ever more sensational stories as clickbait to keep outraged or obsessional viewers glued to their screens. Psychographic targeting of specific audiences as likely buyers or voters use MRIs and deep psychological research, such as that of Cambridge Analytica on Facebook, were used by the presidential campaign in the US 2016 election, but were initiated by the Obama campaign and Google in the 2012 election. This kind of manipulation of voters, along with “fake news” and Russian bots, influenced Britain’s Brexit referendum and is now widely used in many democratic countries. These election strategies are detailed by Kathleen Hall Jamieson in “Cyberwar: How Russian Hackers and Trolls Helped Elect A President: What We Don’t, Can’t and Do Know” (2018).

The internet itself has become overtaken by commercial market forces and advertising, as well as government surveillance, as in China’s social credit system, and is weaponized by Russia and other countries as cyber warfare, as I have described in “The Future of Democracy Challenged in the Digital Age” (Oct. 2018). Former Harvard Business School professor Shoshana Zuboff paints a chilling picture examining the way gathering big data from millions of humans in their daily lives is accepted as inevitable, a tragic misunderstanding of George Orwell, whose warnings in 1984 (1949) called for a continual fight against such capitulation to any political “Big Brother” technological servitude. Zuboff’s warnings about such big brother technological inevitability are clear in The Age of Surveillance Capital (2019). I experienced these kinds of Orwellian campaigns for passive acceptance of technological inevitability in my service as a science policy advisor to the US Office of Technology Assessment (OTA), as our reports upset powerful interests. The OTA was shut down in 1996 by incoming Republican congress members. The OTA may soon be revived by Democrats if they win in 2020. A deep battle is being fought over the internet at the International Telecommunications Union (ITU) in Geneva, between the USA, China, and Russia (see “Restoring Net Neutrality” (2017)), as pointed out by A. Klimberg in The Darkening Web (2017), and Malcolm Nance in The Plot To Hack America (2016). The original promise of the internet was of providing an open public forum and information source for all, advancing individual participation and global connectivity. In the USA, allocation of domains was initially overseen by a volunteer group, Internet Company for Assigned Names and Numbers (ICANN). Now ICANN, a nonprofit, dominates internet governance and is challenged for recently allowing the sale of the nonprofit .org domain to a private equity group, as reported by Jacob Malthouse in “The Nonprofit Community is about to lose $90+ Million Dollars a Year.”

In 2019–2020, many Democratic presidential candidates’ platforms aim to break up social media monopolies like Google, Facebook, Alphabet, and Amazon on antitrust grounds. Others want to ban psychographic targeted advertising. US Senators Amy Klobuchar and Josh Hawley demand full-disclosure of all ad sponsorship. Twitter has banned all political advertising, while Facebook still retains the right to run political advertising without checking its veracity. Other politicians and media reformers call for repealing Section 230 of the FCC’s Telecommunications Act of 1996 shielding social media companies from the content verification and curating rules imposed on media companies. This allowed these social media companies to describe themselves as mere “technological platforms” with no responsibilities for the content on their platforms, even though they are evidently used as primary news sources by millions daily. Some call for restoring the Fairness Doctrine and “Equal Time” provisions in the original FCC rules. In the Communications Act of 1934, testimony by media CEO Sarnoff had assured lawmakers that the US public would never tolerate advertising on news broadcasts! These rules, however, were lobbied off the law books by the National Association of Broadcasters in the 1980s. Others call for the young technocratic leaders of Silicon Valley’s social media advertising giants to be required by law to read the US Constitution and the Federalist Papers. Facebook’s own staff in Britain have challenged Mark Zuckerberg’s policy of “allowing politicians to weaponize our platform by targeting people who believe that content posted by political figures is trustworthy,” as reported in New Scientist (Nov. 9, 2019). The earlier subscription revenue model of AOL is now successfully revived by The Guardian, which became a foundation and rejects all advertising. This subscription model is hard for new entrants since it needs existing audiences.

How will all these current debates evolve markets in new directions? Digital assets traded over the internet globally, along with many electronic barter platforms, are further displacing traditional currency-denominated asset valuation on stock markets. Unpaid productive work, long ignored in GDP, along with its missing asset account to record the value of taxpayer-funded infrastructure, R&D, and support for startup businesses are finally creeping into mainstream statistics. The UN Human Development Report’s Human Development Index (HDI) found in 1995 that $16 trillion of valuable unpaid work was simply missing from global GDP of $24 trillion. If this unpaid production in all societies ($11 trillion by the world’s women and $5 trillion by men) had been included, global GDP for 1995 would have increased to $40 trillion (www.undp.org). The unacknowledged taxpayer contributions in R&D and assistance to the private sector for most Silicon Valley giants is documented by economist Mariana Mazzucato in The Entrepreneurial State (2013). Brazil’s insistence that the IMF add to its GDP figures the taxpayer investments in its urban infrastructure, airports, sanitation, universities, and hospitals substantially lowered Brazil’s apparent debt-to-GDP ratio—with the stroke of a pen! These omitted statistics missing from GDP were examined in 2003, at the First International Conference on Implementing Indicators of Sustainability and Quality of Life (ICONS) in Curitiba, Brazil, with over 700 professional attendees from statistical offices around the world (“Statisticians of The World Unite!” IPS (2003)). Economists still are dominant policy advisors in too many governments, in spite of their abject failures to foster more equitable, sustainable economies, or to predict financial crises, including the 2008 meltdown (predicted by many, including this author, from other disciplines). Yet all their economic textbook theories have been invalidated by scientific research in thermodynamics, biology, ecology, psychology, anthropology, and systems models, as I summarized in “Mapping the Global Transition to the Solar Age: From Economism to Earth Systems Science,” Foreword by NASA Chief Scientist Dennis Bushnell, London (2014). Robert Skidelsky, author of the masterwork on Keynes, confirms this denouement of the economics profession’s pretensions to scientific status in Money and Government: The Past and Future of Economics (2019). Many others have documented economists’ specious use of mathematics to camouflage their untenable, obsolete assumptions, as described by David Graeber in “Against Economics,” his review of Skidelsky’s new book in the New York Review of Books (Dec. 5, 2019).

The most comprehensive approach to enacting structural reforms to our current lawless digital monopolies are those of Rana Foroohar, business editor of the Financial Times, as detailed in Don’t Be Evil (2019). Foroohar emphasizes that our human data is the new “oil,” and how this changes economies and requires new approaches to governance. Similar new conditions and reforms also are cited by Naomi Klein, former US presidential candidate Andrew Yang, and many analysts at the American Sustainable Business Council conference on the future of capitalism, “Making Capitalism Work For All” (Dec. 10–11, 2019).

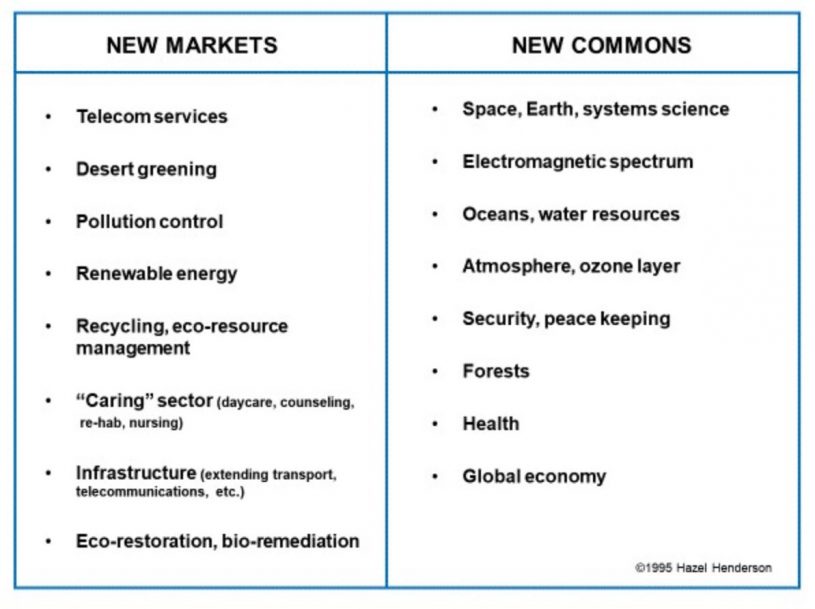

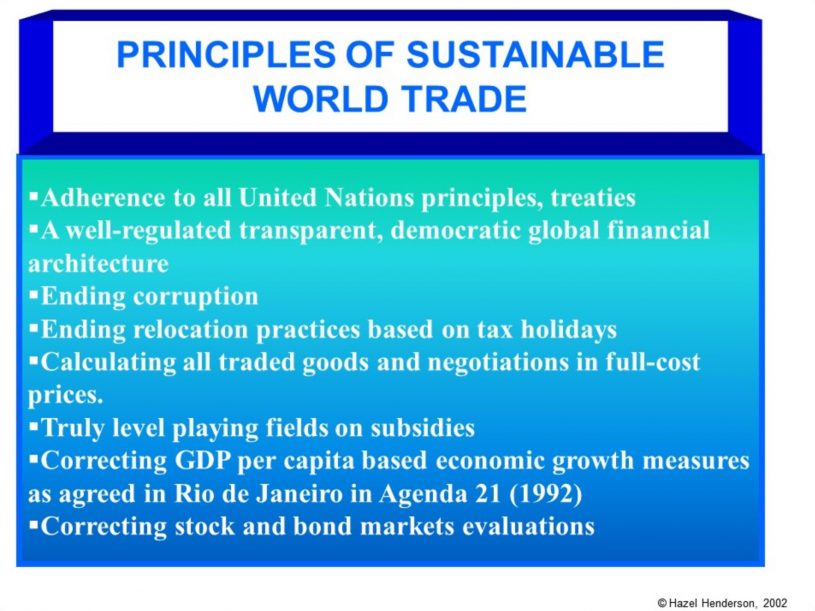

My view is that while capitalism may not survive in any of its current forms, markets will continue since they are deeply coded in the cultural DNA of all human societies. Today, we see new markets and new commons as we explore the evolving global playing field. Markets can be tamed, transformed as they always have been, guided by robust feedback from investors, NGOs, community norms, new regulations at all levels, and by consumers and citizens. Advertising can be regulated, false claims exposed and limited by withdrawing its no-longer-needed tax subsidies to fund countering exposure, as well as upgraded to educate on sustainability. The profession of psychology can promote higher standards in its code of ethics.  Trading can be curbed whenever it becomes harmful to individuals and society and Principles of Sustainable World Trade can be adopted. This will all require systemic changes, reducing the role of money in politics, and reforming many features of democratic decision-making and governance. Humans create markets and are constantly reshaping them as technologies evolve and human awareness expands. For example, global gem mining is now unnecessary, yet still destructive to miners and the environment (Beyond Blood Stained Gems: New Science and Standards (2015)). The growing global market for identical lab-created gems is gradually taking market share (see www.ethicmarkgems.com). Humans will need to embrace all the planetary realities in tackling climate change and other global problems arising out of our limited cognition. We are acknowledging that money is not wealth, but merely a useful informational tracking system for our interactions with each other and natural resources. Currencies are social protocols, information, often as tokens, exchanged on internet platforms with network effects determining their prices, as measured by how many people use and trust them, as I describe in “Money is not Wealth: Cryptos v. Fiats” (2018). Cryptocurrencies can desist from visual fake images of shiny coins to promote sales, since cryptos are actually strings of digits in computer code. We also can agree that prices are always historical and a function of human ignorance. Like all our markets, prices change as we learn more about our real human condition and future possibilities on this small planet.

Trading can be curbed whenever it becomes harmful to individuals and society and Principles of Sustainable World Trade can be adopted. This will all require systemic changes, reducing the role of money in politics, and reforming many features of democratic decision-making and governance. Humans create markets and are constantly reshaping them as technologies evolve and human awareness expands. For example, global gem mining is now unnecessary, yet still destructive to miners and the environment (Beyond Blood Stained Gems: New Science and Standards (2015)). The growing global market for identical lab-created gems is gradually taking market share (see www.ethicmarkgems.com). Humans will need to embrace all the planetary realities in tackling climate change and other global problems arising out of our limited cognition. We are acknowledging that money is not wealth, but merely a useful informational tracking system for our interactions with each other and natural resources. Currencies are social protocols, information, often as tokens, exchanged on internet platforms with network effects determining their prices, as measured by how many people use and trust them, as I describe in “Money is not Wealth: Cryptos v. Fiats” (2018). Cryptocurrencies can desist from visual fake images of shiny coins to promote sales, since cryptos are actually strings of digits in computer code. We also can agree that prices are always historical and a function of human ignorance. Like all our markets, prices change as we learn more about our real human condition and future possibilities on this small planet.

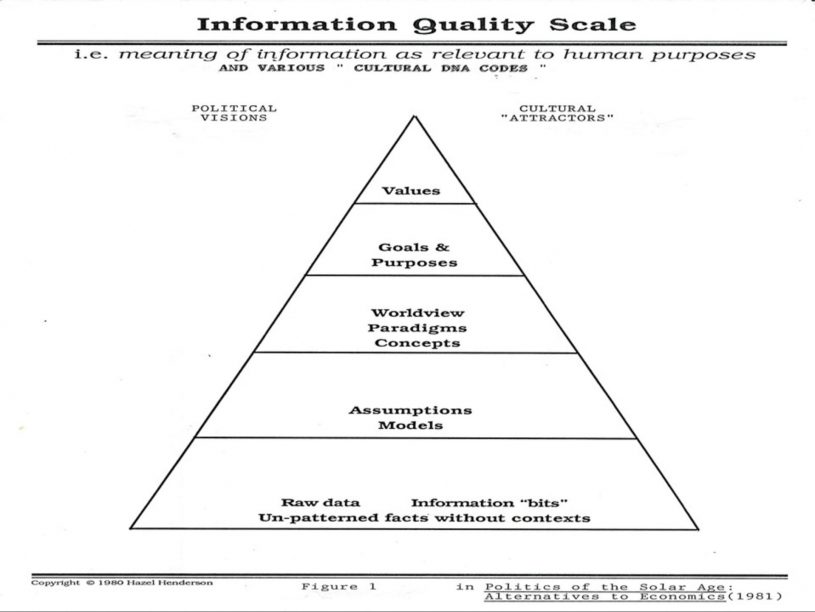

We are finding that breakdowns drive breakthroughs, and that stress is evolution’s tool, evolving all species through environmental conditions and natural selection as Charles Darwin described. Our next technological stage—the Solar Age—is rapidly taking over, along with the primacy of information. Hopefully, information can grow into greater wisdom and lead to more ethical choices, both individually and collectively, as we clarify new markets and how our global commons must be shared equitably among our species and with other species in maintaining our living global biosphere.

We are finding that breakdowns drive breakthroughs, and that stress is evolution’s tool, evolving all species through environmental conditions and natural selection as Charles Darwin described. Our next technological stage—the Solar Age—is rapidly taking over, along with the primacy of information. Hopefully, information can grow into greater wisdom and lead to more ethical choices, both individually and collectively, as we clarify new markets and how our global commons must be shared equitably among our species and with other species in maintaining our living global biosphere.