Wall Street to Main Street to World Street

The doomsayers work by extrapolation; they take a trend and extend it, forgetting that the doom factor, sooner or later, generates a coping mechanism. You cannot extrapolate any series in which the human element intrudes. History, that is, the human narrative never follows, and will always fool the scientific curve. -Barbara Tuchman

Some say the economic apocalypse is upon us.

The Covid-19 global pandemic that escalated in March, was followed in June by mass protests, massive unemployment, thousands of businesses bankrupt or closing permanently, long lines at food banks, over 100,000 deaths in the United States alone, healthcare workers pushed to the brink by the virus, contradictory state and federal leadership, escalating tensions with China, and deteriorating relations with Russia over election meddling. Amid these chaotic events, the US Presidential Election is coming up this November.

It is as disheartening as it is chilling to see this misery. – is America falling apart?

Disasters have turned into financial panics before, often when leaders lose their way. Yet, when viewed in a larger context, we see that extreme situations do not last. No trend is endless. It helps me to remember the words of Abraham Lincoln, ‘This too shall pass.’ Leaving us, of course, to make sense of the new landscape.

A literary work that symbolizes the current situation for me is Lewis Carroll’s, Alice in Wonderland, written in 1865. Alice falls through a rabbit hole into a subterranean world. There, Alice worries about what final size she will end up being, engaging in a quest for identity and growth, and pondering the logic of rules, the games people play, authority, time, and deal-making.

We are on a similar quest to understand our global economy, and the unsettling disconnects between Wall Street, Main Street, and what I call World Street.

WALL STREET

Growing Up in Manila, the only ‘bears’ I saw were in pictures. And a bull to me was the Philippine water buffalo called carabao. I didn’t know a bull and bear could mean anything else in the investment world of the 1960’s when the market was riding high.

The 60’s were the ‘go-go’ years of super-performing money managers, youth revolution, the conglomerates, creative accounting, new issue stocks, and the growing power of institutional investors and traders. America’s economic might made it the leader the West. Then, in December 1968 the Dow Jones fell 36%.

Right around that time, I was appointed director of investment research and assistant treasurer at the Ford Foundation, the first woman and youngest officer in the Foundation’s history. For the next seven years, I served as manager of the Foundation’s research staff and spurred the globalization of its $3 billion portfolio by investing $150 million into the Japanese market, as well as other foreign markets.

Ever since the 1970’s, Wall Street and financial services around the world have been characterized by a sharp intensification of competition and a rapid transformation of markets. The end of the Cold War and the spread of globalization which started in the 1980’s and the rise of China as an emerging superpower all happened within just 33 years. But the globalization boom, like the stock market boom and economic boom, was also followed by a bust.

Twelve years ago, in the years 2008-2009, when the worst financial and economic crisis gripped the global economy, the world was in a state of shock and made the case for urgent reforms. But instead, the markets had a powerful bull market rally for 11 years which just ended in March 2020 after the pandemic crisis hit the US and the market lost a third of its value.

Since its gut-wrenching selloff in March, the market has rocketed and recovered more than half its losses with its ‘V-shaped’ recovery as of this writing. This rosy view from Wall Street should make us uneasy since it is a world away from life on Main Street with the highest unemployment in 80 years, the risk of a second wave of infections looming, and civil unrest.

Wall Street’s stock market is not the economy of Main Street and while Wall Street and the financial system is an essential part of any market economy, it is a complex and fragile network of trust. The lesson of the current financial crisis is that such networks are prone to abuse and then to collapse. So, now what?

The late John Templeton, who achieved a remarkable investor’s record said that if you begin with prayer, you can think more clearly and make fewer stupid mistakes.

Some might scoff at such a sentiment, but the challenges of the coming decades make the case not only for urgent reform, but for a more conscious, even ‘spiritualized’ financial system. The principle of caveat emptor – ‘let the buyer beware’ does not work anymore. People need protection from predatory practices and renewed trust in corporate governance. Regulators need to watch the buildup of leverage. And companies need to be accountable once again. Capitalism has always evolved and is capable of doing so now. The test will be determined by what we value and how we act.

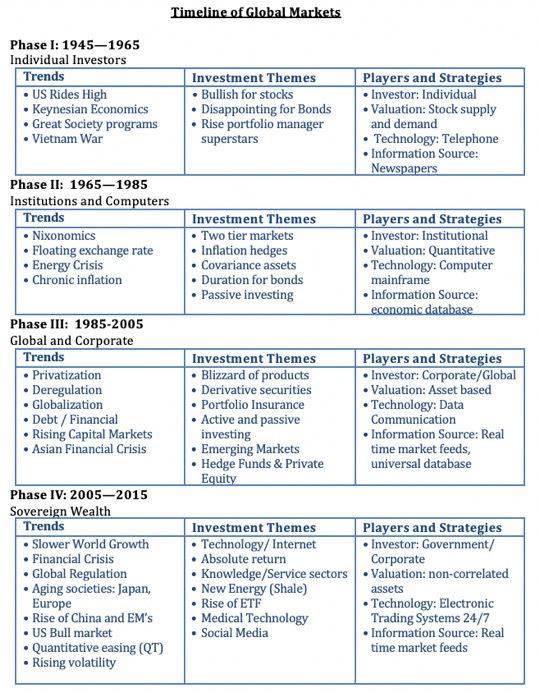

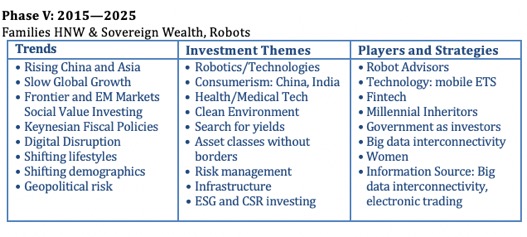

Here is a table on the global investment landscape that notes key trends and themes from 1945 to a future timeline ending 2025. These changes are leading to the emergence of more dynamic markets, quite distinct from previous decades.

Source | Clemente Advisors, LLC and ETF Asia Analytics Inc., June 2020

Source | Clemente Advisors, LLC and ETF Asia Analytics Inc., June 2020

So where do we go now, Wall Street?

Given the trends and investment themes in the Phase V Timeline, from 2020 to 2025, meaningful growth and progress will require new ways of thinking. Corporate growth and strong Wall Street markets have been engines of progress, yet the same engines have created or contributed to the biggest obstacles we face today – income disparity and environmental degradation. It is past time for Wall Street businesses to look beyond quarterly profits and act in the interests of society.

Imagine investing in job training for the underserved, or conserving key forests and other habitats for future generations, or in bioregional enterprises that are regenerative. These are examples of social impact investing today. New investment structures and partnerships with nonprofit organizations, government agencies and Small Business Administrations (SBAs) are offering creative opportunities at all scales, local to global.

We are in the midst of a demographic shift in the US and globally. Millennials born in 1981-1997 are the largest living generation in US history, alongside Baby Boomers reaching retirement. Millennials will account for 75% of the labor force by 2025 and will hold about $68 trillion in wealth by 2030 as a result of intergenerational wealth transfers, or inheritance. US Millennials are on the verge of becoming big players in the global investment landscape. They identify as global citizens, as they consume, borrow, invest, save, and unleash funding for social and environmental causes. Millennial investing will drive change and present numerous opportunities for companies, industries and financial services.

Slower growth and the rise of emerging and frontier Asian markets, deep investment in solar and regenerative technologies, and the empowerment of women and millennial inheritors all spell hope for a future economic landscape that is more cooperative and collaborative, focused on people, planet and purpose rather than profit alone.

MAIN STREET

Social distancing and national lockdowns, travel bans and halted tourism, business and school closures, volatile markets – recent circumstances defy comparison to crises of the past. Made more complex by its speed and global scale, this pandemic is unlike anything we have witnessed in our lifetimes.

All countries face the threat of a global healthcare crisis, economic recession, and financial meltdown. And decisions made now can be life or death ones. As long as the rate of COVID diagnosis continues to increase, business will be impaired, markets will be volatile and forecasting hazardous. Much of our hope lies in the medical profession with scientists and drug companies racing to find vaccines and anti-viral treatments.

How bad is it? In the midst of a downturn on Main Street, describing severity is a real challenge – things are changing so fast that the traditional data and economic metrics cannot keep up. What are the real numbers on poverty and inequality? And what is happening to America’s shrinking middle class?

The US government has passed several relief packages to address the effects of the coronavirus, spending about $3 trillion, (more than 10% of the real GDP) on loans and grants for businesses to maintain payrolls and rent payments, as well as to prop up severely depressed industries like airlines. The US Federal Reserve also injected 2.3 trillion of liquidity into the monetary system to help keep order and support financial conditions. But are these the best tools at hand? Is the relief even going to the right places? This is where moral leadership is required.

The missing link in this free market fundamentalism is the recognition, central to capitalism that business has greater responsibility than bottom-line profits. Adam Smith, a founder of modern capitalism, understood that economic freedom can’t flourish without a strong moral foundation. Yet, we see examples of capitalism without a conscience everywhere -environmental pollution, unfair hiring and working conditions, sale of dangerous products, and so on.

And what about our extensive and dilapidated infrastructure in the US? Take a ride on our pothole-filled roads and decaying bridges and tunnels built during Roosevelt’s New Deal. The late Felix Rohatyn’s book, Bold Endeavors; How our Government Built America and Why It Must Rebuild sums it up; The aging of our nation’s infrastructure has lessened our productivity, undermined our ability to compete in the global economy, shaken our perceptions about our own health and safety, and damaged the quality of American life. And then there is the state of our children’s education. Historically, education has been a great equalizer but we’ve slipped further and further behind in the global ranking.

Yes, times are hard with this 2020 recession and contrary to what pundits say, fixing up Main Street’s economy will take time and won’t look like the sharp recovery shapes of V, L, U. What are we going to do about it? We cannot just rely on government to fix things.

We need to begin in the places where we live. What do we want the ‘new normal’ to look like? Look around. What is the condition of our local and bioregional food and water system? How do we currently meet our needs as a community? Is there economic opportunity for everyone and help for those most at-risk? Are local businesses, schools, and organizations supported? Are parks, waterways and wildlife protected? This is where we need to invest time and creativity, as well as social, spiritual, and financial capital.

When viewed in a more local context, many of our problems are manageable. As we shift from ‘me’ to ‘we’, people-powered movements are gaining momentum around the world. When we begin to invest in these efforts across time and space, the opportunities to build a new kind of capitalism is unlimited. The time to start is now.

WORLD STREET

Today’s global economy is genuinely borderless. Information, capital and innovation flow from all over the world, enabled by technology. The torrential cross-border flow of capital is breaking down barriers across cultures, minds and yes, hearts. Time and distance continually shrink, compelling people to explore their differences.

Several sets of processes co-exist – localizing, regionalizing, internationalizing, globalizing. We live in a world of increasing interconnectedness as well as volatility; a world in which the lives and livelihoods of every one of us are bound up with processes operating at larger geographical scales.

Such a system has to be built on a world trading system that is equitable and must involve major reform of such institutions such as the World Trade Organization (WTO), World Bank, and International Monetary Fund (IMF). Trade is one of the most effective ways to enhance wellbeing, when it is conducted fairly, and when poorer countries are allowed to open up their markets in a manner appropriate to their needs and condition. The major challenge is to meet the material needs of the global community as a whole, in ways that reduce, rather than increase inequality and to do so while protecting and regenerating ecosystems. That is, of course, easier said than done since it requires the cooperation of multiple participants – businesses, nations and international civil society in establishing mechanisms to capture gains of globalization for the majority and not just for the powerful few.

Although difficult, such policies are not impossible if the social and political will is there. The imperatives are both practical and moral.

But when the poorest people are fed a steady diet of media glorifying immense wealth and fame it does no good to support social and political stability. It is utterly repellent to me that so many live in deprivation while others live in luxury. We need the will to express what we value, create the narratives that reinforce those values, and live them.

International financial flows and foreign currency transactions have reached unprecedented levels. They easily dwarf the value of international trade and manufactured goods and other services and have done so at an increasing rate over the past three decades. Today in the context of globalization, the tension has become especially acute as nations see traditional control of their monetary affairs threatened by external market forces. The periodic financial crises that have engulfed some or all parts of the world economy serve to intensify these tensions and create legitimate fears over the accountability and responsibility of financial institutions.

The global integration of financial markets brings many benefits to participants in terms of accuracy of information flows and speed of transactions across the world in different time zones. But such global integration and instantaneous trading also has its costs. We experience ‘shocks’ which occur in one geographical market and spread instantaneously around the world, creating the potential for global financial instability. Financial ‘contagion’ is endemic in the structure and operation of the contemporary global financial system. Although many of the restrictions still exist, the regulatory walls have been crumbling, even collapsing altogether in some cases.

CONCLUSIONS

My field, global investing provides me with a window on the world that gives me connections between people and events, between reason and intuition, between the past, present and the future. And being a Filipino-American with multi-cultural heritage provides me with the eyes to see such connections globally.

Recently, the character and tempo for globalization has changed. Even before the pandemic crisis of 2020, globalization was in trouble. When did the slowdown begin? The open system of trade that had dominated the world economy for decades was damaged by the financial crash of 2008 and the China-American trade war. The pandemic shock now ripping through business is daunting, with countries accounting for over 50% of the world GDP in national lockdown.

Yet, Wall Street analysts expect only a slight dip in profits in 2020, given the fact that few public listed firms have made public their calculations on the damage caused by the lockdown. Don’t be fooled by this. In this downturn, falls of over 50% will be common with empty streets and factory shutdowns. Trade is suffering from disrupted global supply chains as well as the flow of capital, as long-term capital sinks. And by attempting to pay off new debts by taxing firms and investors, some countries may be tempted to restrict flow of capital across borders. Global firms may be less profitable.

As economies re-open, please don’t expect a quick return to a carefree world of free trade. Movement of people and goods face restrictions in travel and immigration, which will affect the ability to find work. Like all crises, the Covid-19 calamity will pass and hopefully needed changes will be made. History usually does not evolve in an orderly way. It often leaps forward in disorderly jumps. We are having a crash course in digital currencies, e-commerce and isolated work from home.

In an increasingly complex society, old ways are no longer guaranteed to work. Values are the emotional rules by which a nation governs itself. Values summarize the accumulated wisdom by which a society organizes and disciplines itself. Our values and goals are the precious reminders that individuals obey to bring order and meaning into their personal lives.

The wakeup call in this current pandemic is the movement toward commitment to shared values and goals.

What should these goals be? Nationally, there must be a demand for public service, to see society protected and social injustices addressed. There should be encouragement to blow the whistle on wrongdoing. Individually we must develop compassion, willingness to work, loyalty and love of family and friends and commitment to communities and organizations, as well as the courage to face temporary defeat. Treat all people with justice. Look after your own health and that of others. And we’ve got to keep reviewing and updating our value decisions regularly.

Today’s economic crisis is smaller than that of 1930’s—so far. Yet it is a major event in our lifetimes, with resulting shifts in geopolitical economic power. Whether this brings forth ‘urgent reforms’ in the near term remains unclear. But transformation to a more conscious, collaborative economic future is possible if we have the will to seize it. The new decade is here and it will never, ever be business-as-usual again.

Remember the words of Rabindranath Tagore, “Let me not pray to be sheltered from dangers but to be fearless in facing them.”

Lilia Clemente is a giant amongst Filipino-Americans and iconic Wall Street titans / Fund Managers. It is a true honor, privilege, and blessing to know and be mentored by her! For global Corporate Executives, UHNW Family Offices, and both the novice and seasoned investors alike, this is a must-read article–as we navigate through and make sense of the surreal Covid-19, Pandemic world.

Thank you Joe. We love Lilia here at Kosmos 🙂